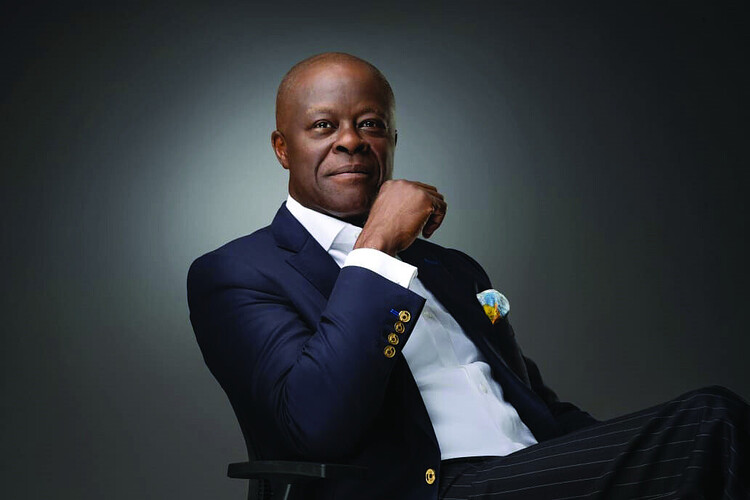

Wale Edun, the Minister of Finance and Coordinating Minister of the Economy, has categorically ruled out the likelihood that the nation’s tax rates will increase.

Ahead of increasing taxes, he stated that his ministry would prioritize revenue generation for the fiscal year 2024, as opposed to increasing levies, during an interactive session with the House of Representatives Committee on Finance, which he presided over.

The objective of the interactive session involving the committee, the Minister, and government-owned enterprises (GOEs) was to increase revenue generation for the 2024 budget beyond the projected N27.5 trillion.

In response to inquiries from committee members, the minister maintained that increasing taxes would be counterproductive, given the country’s need to attract both domestic and international investors.

“You did state that a tax increase is in the works,” the author noted. In and of itself, there are no intentions to raise tax rates. A strategic initiative is underway to augment tax revenue. The objective is to raise tax returns and tax revenue as a proportion of GDP from approximately nine percent to eighteen percent, which is closer to the African average, within three years.

Therefore, prioritizing tax collections takes precedence over raising tax rates. It is specifically enhancing the collection aspect of tax administration in terms of efficiency.

“Within an initiative that relies on investment—as you noted, both domestic and foreign investment—are dependent on private sector investment to stimulate economic growth, generate employment opportunities, and alleviate poverty—the objective is to potentially decrease taxes to enable individuals to allocate more funds towards production and job creation. It is critical to emphasize this point.”

The Minister, while acknowledging the insufficiency of government spending on critical social services and infrastructure such as education and healthcare, emphasized the need to reduce government expenditure leakages and waste.

The Minister, who emphasized the importance of transparency regarding oil revenue, stated that the budget projections for 2024 are still rational when considering oil production, the exchange rate, and borrowing costs.

As a result, the Nigeria Customs Service (NCS) and the Committee have agreed to raise the revenue objective for the service from N5 trillion in 2024 to N6 trillion.

Bichi implored Adewale Adeniyi, the Comptroller General of NCS, to investigate the feasibility of increasing the allocated N5 trillion to implement the renewed hope initiative of President Bola Tinubu.

He praised the president’s presentation of the 2024 appropriations bill and added that it could only become a reality if sufficient funds were available to satisfy the N27.5 trillion proposal.

The NCS chief stated that it is feasible to generate N6 trillion in revenue by the year 2024.

He stated that this is contingent upon the 2024 evaluation of the issue of concession grants.

“Achieving N1.8 trillion in revenue within a year demonstrates that reaching N6 trillion in revenue by 2024 is attainable,” he continued.

He stated that many of the products at the ports had not yet been cleared and that several bills remained unopened when the NCS examined its system.

An internal audit revealed that the NCS earned over N11 billion from that endeavor, he said, adding that there were still a great number of products that required clearance.

He stated that the service lost N1.8 trillion to Import Duty Exception Certificates (IDEC) in 2023, and that excise constituted 18 percent of total revenue in the same year.

He remarked, “About the possibility of N6 trillion, I wholeheartedly concur that this is entirely conceivable.” Our current operational environment concerns notwithstanding, it is not inconceivable that we could reach $6 trillion; however, we are aiming for $5 trillion.